- National Bank of Ukraine

- News

- All news

- Economy Explained (Based on January 2024 Inflation Report)

Every quarter, the NBU updates its economic forecast and publishes it in its Inflation Report. The report contains a lot of useful information but is intended primarily for professionals. This webpage was created to make it easier for anyone to learn about major economic events and the NBU’s vision for the future development of the Ukrainian economy.

The NBU’s updated forecast is based on an assumption that, starting in 2025, security risks will subside significantly thanks to efforts made by the Armed Forces of Ukraine. This will fully restore operations of Ukrainian Black Sea ports, stimulate investment in the reconstruction of the country, and encourage forced migrants to come home.

How is the economy holding up?

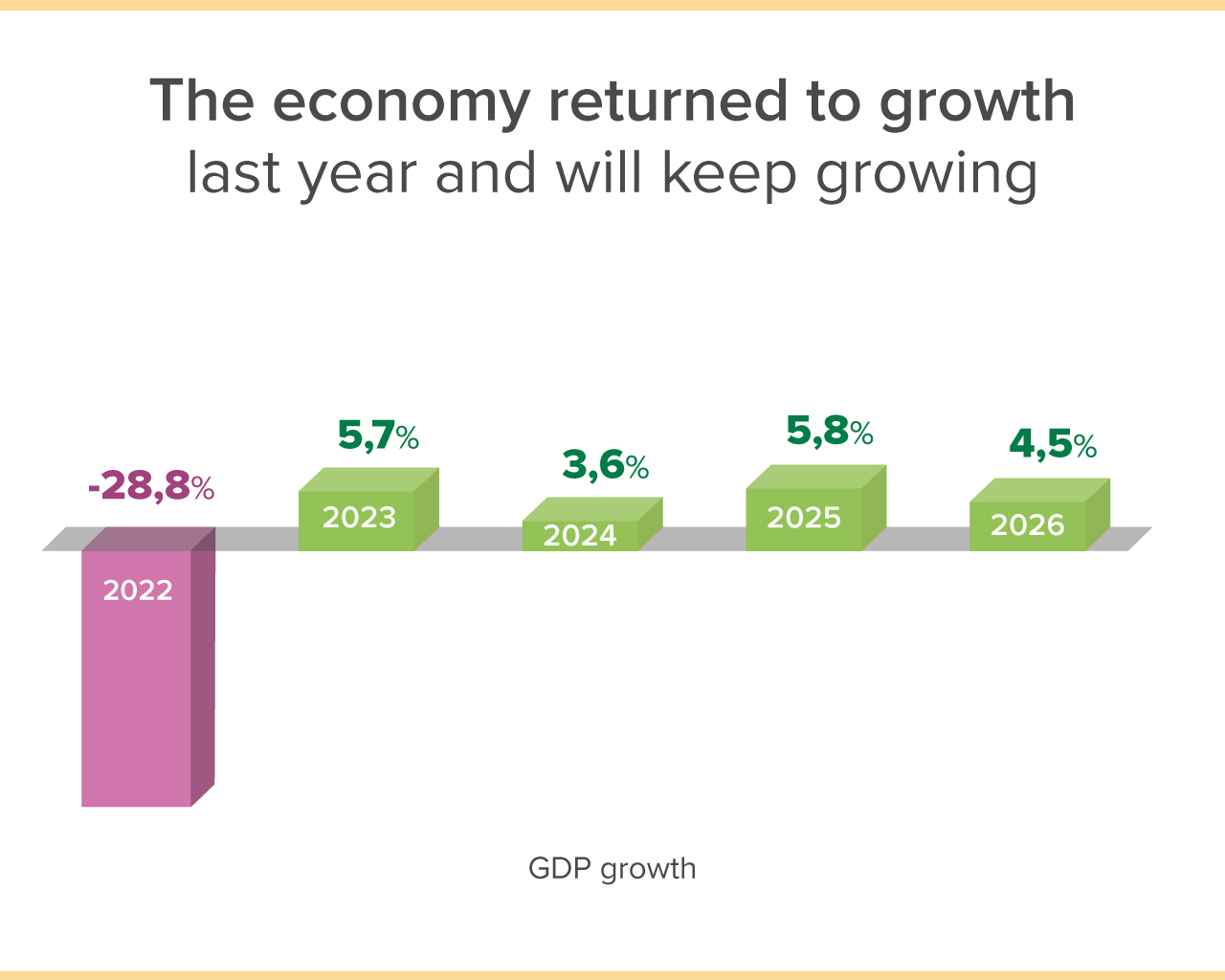

Despite the ongoing war, Ukraine’s economy grew by almost 6% last year. High adaptability of businesses and households to operating in wartime played an important role. In spite of high risks, companies were not afraid to invest in development of their business. At the same time, russia’s missile attack terror have not halted any of the economic sectors: neither the energy sector, nor the metals industry, nor farmers. Furthermore, farmers even managed to gather a strong harvest with record-breaking crop yieldsCrop yield is the amount of agricultural produce harvested per unit of land area. Crop yield and harvest are two different terms. Due to the occupation of territories and land mines, farmers have been harvesting less in recent years than before the full-scale invasion. However, thanks to favorable weather conditions and hard work, farmers have been managing to achieve not just good, but record-high yields, as was the case in 2023..

High budget expenditures contributed significantly to the economic growth. The government spent money on the army and related sectors, reconstruction of infrastructure, and social security (pensions, wages, and various types of assistance). This spurred demand for goods and services and encouraged businesses to increase production. The high budgetary spending, in turn, was made possible by inflows of international financial assistance totaling around USD 43 billion.

An important event for the economy was the opening of a new sea corridor with the support of the Armed Forces of Ukraine and international partners. The new route compensated for the losses caused by the termination of the so-called grain deal in July 2023 as russia withdrew from it unilaterally. Now Ukrainian companies are exporting their goods by sea without having to undergo russian inspections. Moreover, businesses are now able to transport not only grain but also other goods, including metallurgical products. This route is also being tested for importing products to Ukraine.

The NBU forecasts Ukraine's real GDPReal gross domestic product is the value of all goods and services produced in an economy for final use. When talking about economic growth or decline, we often mean a change in real GDP. to grow by another 3.6% this year, despite the ongoing war. High budget expenditures will remain a strong driver of economic growth. Of course, an important prerequisite for this is further strong support from international partners. The NBU assumes that the external financial assistance will amount to around USD 37 billion this year.

As the security situation improves, next year seaports are expected to fully resume operations, and companies to set up optimal supply and production chains. Subsiding war risks will also encourage businesses to invest more in new projects and reconstruction, and migrants to gradually return home. All of this, according to the NBU’s forecast, will help accelerate economic growth to 5%–6% in 2025–2026.

What about prices?

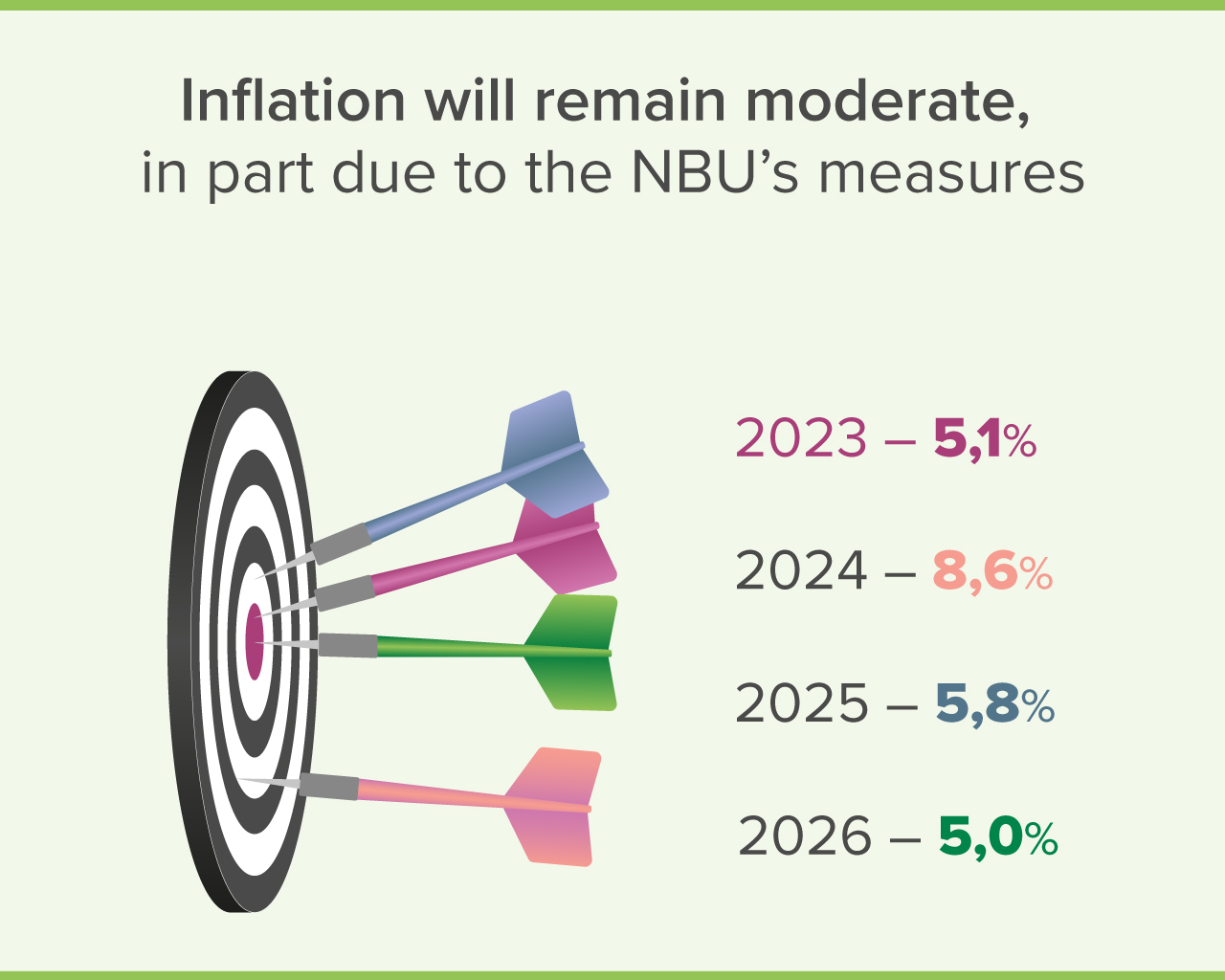

Inflation Inflation is the growth rate of the overall level of prices for goods and services in a country. in 2023 declined sharply compared to the end of 2022. Whereas consumer prices rose by 26.6% in the first year of the full-scale war, they rose by only 5.1% last year. Fixing tariffs for certain utility services (supplies of natural gas, heating, and hot water) remained an important factor in restraining inflation. In addition, thanks to good harvests, the growth in food prices slowed markedly.

A decline in certain production costs for raw materials and logistics also played an important role. For example, in 2023, crude oil prices fell globally, and food prices decreased in the domestic market, in particular due to strong harvests. Also, the establishment of alternative supply routes made the delivery of goods less expensive.

The NBU's measures to maintain the sustainability of the foreign exchange market also contributed significantly to the slowdown in inflation. First, the NBU actively supported the hryvnia exchange rate by selling foreign currency from reserves. Second, it ensured the attractiveness of hryvnia savings instruments (depositsAs of the start of 2024, the rates on retail term deposits averaged around 14%–15% (11%–12% after tax). This is higher than expected inflation. and domestic government debt securitiesDomestic government debt securities are securities issued by the government of Ukraine and guaranteed by the state. Ukrainians can buy them in the banks’ apps or on the Diia public service portal. Interest rates on hryvnia-denominated domestic government debt securities range from 14% to 19%, depending on the maturity. Income on these securities is not taxed.), which restrained the demand for foreign currency. As a result, the situation on the foreign exchange market remained under control, and exchange rate fluctuations were moderate and not threatening.

The NBU forecasts inflation to accelerate only moderately this year, to 8.6%. The main reason for this will be slightly lower harvests, as last year's high crop yields were due to extremely favorable weather conditions, and this year's yields are likely to be close to average climatic norms. In addition, the adverse effect of the war on business costs will persist. At the same time, the NBU expects that in the coming years, as the security situation improves, inflation will return to the target range of 4%–6%.

What will happen to jobs and wages?

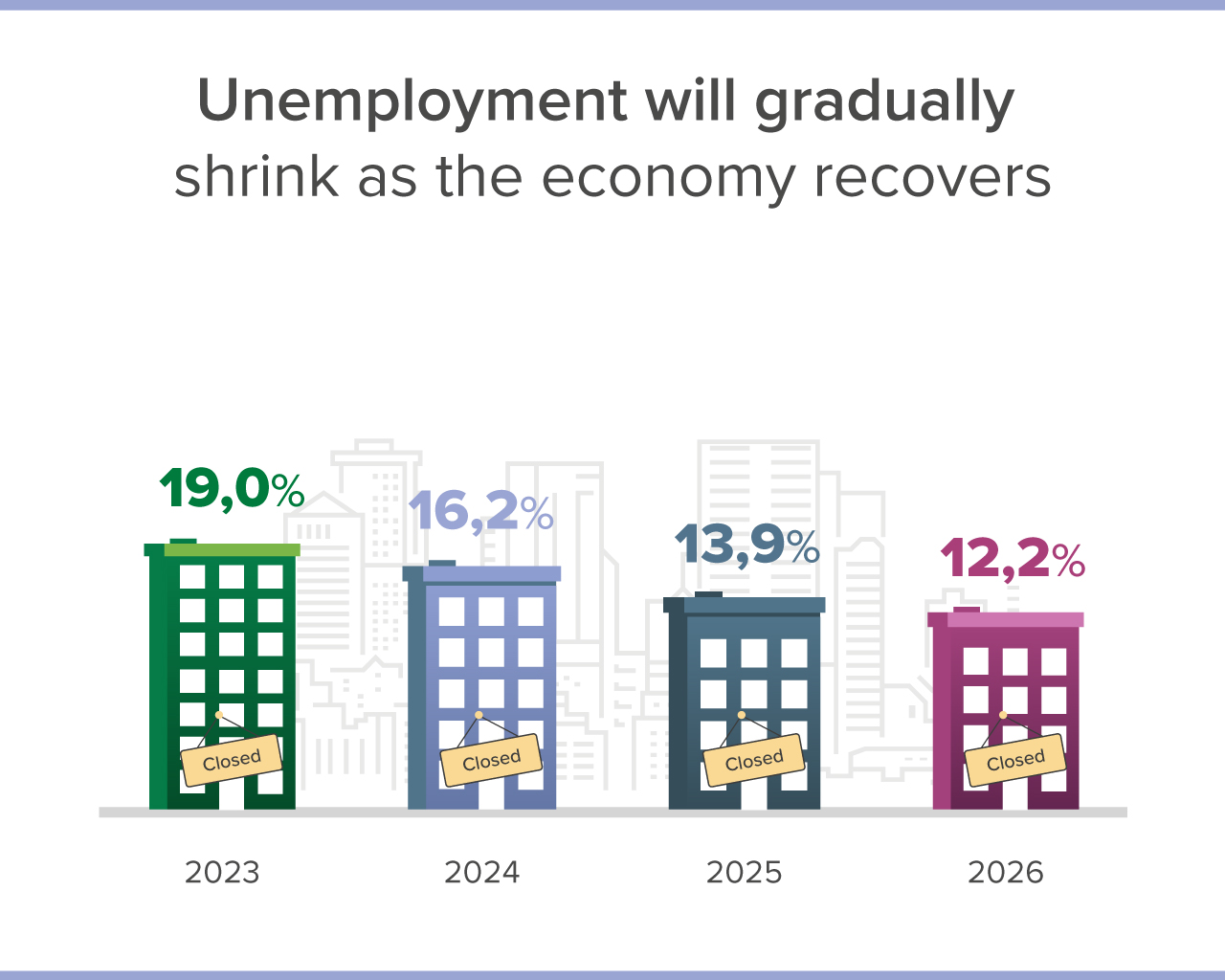

Businesses are more actively looking for new employees than they were a year ago. The number of vacancies is growing, and some companies – especially in the trade and services sectors – even expect to expand their staff in the near future. However, companies often fail to find specialists with the necessary skills due to structural mismatches in the labor market. Even before the full-scale war, businesses faced the problem of finding qualified personnel, and mobilization and significant migration have further complicated this process. As a result, the unemployment rate is declining, but very slowly.

At the same time, growing competition for skilled workers is pushing companies to gradually raise wages. Meanwhile, many companies are increasing wages in both nominal and real terms – that is at above the inflation rate. According to NBU estimates, real wages in Ukraine grew by 3.5% on average last year.

The NBU forecasts a further decrease in unemployment and increase in wages. Demand for skilled workers will only rise, especially if the security situation improves next year. The country's reconstruction will require new workers, so companies will actively compete for employees, including both for defenders returning from the frontline and for migrants going back home. This competition, in turn, will continue to push up real wages.

How are loan and deposit rates changing?

Given the rapid decline in inflation, in H2 2023, the NBU gradually lowered its key policy rate The key policy rate is a tool through which the NBU influences inflation. The NBU makes transactions with the banks at interest rates that are close to its key policy rate. As a result, when the NBU changes its key policy rate, the banks have to gradually adjust their rates on loans and deposits. Consequently, this impacts the exchange rate and consumption decisions. and, accordingly, other rates at which it conducts transactions with the banks. In response, the banks also reduced their loan and deposit rates for businesses and households.

Lower loan rates led to a pickup in lending. At the end of the year, both businesses and households were more active in using bank loans for their needs. This is a positive trend, as the revival of lending further contributes to economic recovery.

At the same time, the decline in rates on hryvnia deposits was moderate and they remained attractive to depositors. Hryvnia retail deposits with the banks continued to grow. The current yields on both hryvnia deposits and hryvnia-denominated domestic government debt securities exceed inflation, which encourages people to save in the national currency.

For its part, the NBU will continue to pursue a monetary policy that safeguards households’ hryvnia savings from inflation. The NBU will also limit exchange rate fluctuations in the foreign exchange market to avoid a significant worsening of households’ and businesses’ expectations. This will ensure an adequate level of confidence in the hryvnia and in savings in the national currency.

|

|

Subscribe to news alerts |