- National Bank of Ukraine

- Financial Stability

- Financial Stability Report

A revival of bank lending to businesses and households is the highlight of the latest Financial Stability Report.

The financial sector continues to operate without interruption, with clients’ confidence in the banks remaining high. The banks are stepping up lending to businesses and households and playing an increasingly important role in rebuilding the economy even despite persisting wartime risks.

This year, macroeconomic conditions were favorable for the financial sector. GDP growth significantly exceeded expectations, and inflation decelerated rapidly. Even having been cut, the key policy rate ensures that hryvnia savings remain sufficiently attractive. A transition to managed flexibility of the exchange rate has been successfully accomplished thanks to the NBU’s measures and the market’s readiness for such a step.

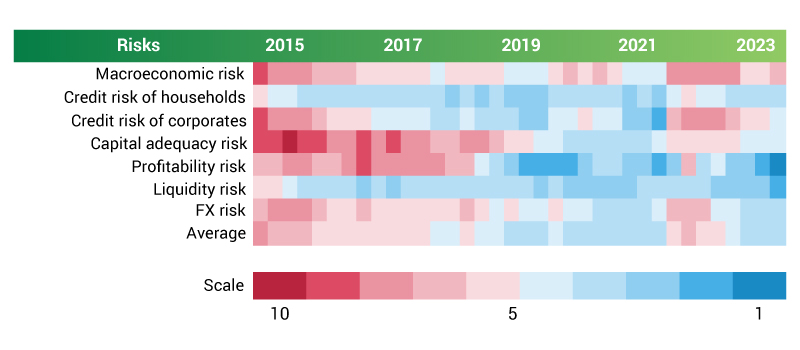

The full-scale war remains the key systemic risk to the economy and the financial sector. Risks that the international aid might become irregular or its volume might shrink have increased. However, the chances of the successful approval of financial assistance packages by Ukraine’s partners are high. The NBU's baseline scenario for 2024 assumes that the macroeconomic preconditions for the stable operation of the financial sector will remain in place: further economic growth, single-digit inflation, manageable FX market, and the sustained attractiveness of hryvnia assets.

The inflow of client deposits to the banks continues, albeit at a slower pace than during the first half of the year. The banks are relying on almost no other sources of funding. High-quality liquid assets account for just under half of the banks' assets. With such a resilience margin, financial institutions will be able to cope even with strong liquidity shocks, which are now highly unlikely.

Hryvnia lending has resumed after a long pause. Hryvnia corporate loans have been growing for six consecutive months. The improved financial standing of companies and a pickup in business activity have increased the demand for and supply of loans. Hryvnia corporate lending continues to be fueled primarily by the Affordable Loans 5–7–9% state program. At the same time, the banks that are outside of the state support programs are building up their loan portfolios as well.

Unsecured retail consumer loans and mortgages are also growing. Two banks that are leaders in unsecured consumer lending have restored their portfolios to the levels they had before the full-scale invasion. Mortgages are granted almost exclusively by the state-owned banks under the eOselia state program. At the same time, preferential-term mortgage lending is gaining pace and reaching more and more households.

The sector has passed the peak of credit losses from the full-scale war. The results of the NBU’s resilience assessment confirm this. Adjustments to prudential provisions were generally minor. Out of the total amount of non-performing corporate loans, around a third are those that emerged during the full-scale war. Some debtors have a chance to resume servicing their loans as economic conditions improve.

The banks incurred almost no provisioning expenses this year, as they offset losses from defaults by releasing provisions for performing asset portfolios, thanks to improved macroeconomic expectations. This scenario is very unlikely to repeat next year. However, the banks will continue to cover credit losses with current operating profits.

Returns on the main groups of the banks’ interest-bearing assets altered due to a considerable cut to the NBU’s key policy rate. The share of income from certificates of deposit is declining, average yields on the portfolio of domestic government debt securities has grown slightly, and the weight of income from lending is on the rise. Interest rates decreased somewhat for loans to businesses, as well as for deposits, especially for corporate ones. The time of peak interest margins for the banks is likely to be over, but the margins will remain high.

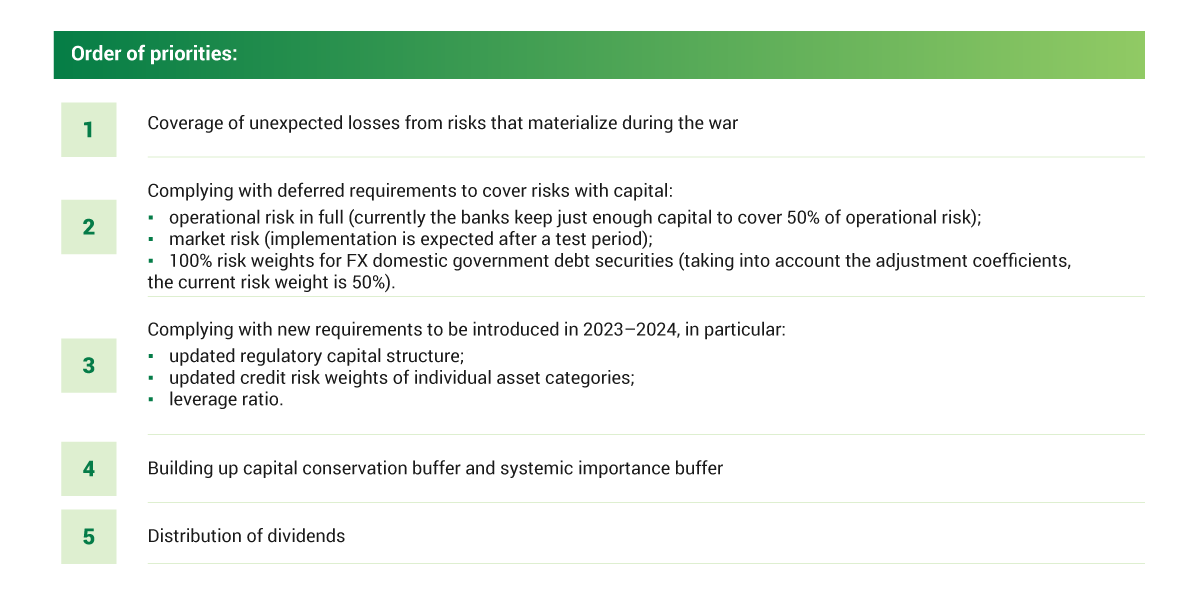

The banks’ high profitability drove an increase in capital adequacy ratios. Currently, the capital cushion is sufficient to cover risks as well as to meet the new planned requirements. The most important of the new requirements are the full coverage of operational and market risks with capital, new regulatory capital structure, and capital adequacy requirements.

Prioritization of uses for the banks’ accumulated profits

This year’s resilience assessment has confirmed that the banking sector has a strong resilience margin. Increased required capital adequacy ratios were set for only five of top-20 largest banks. Early next year the NBU will analyze the feasibility of introducing the capital conservation buffer and the systemic importance buffer. Afterwards, the NBU might ease the restrictions on capital distribution for the banks.

The non-banking financial sector is transforming. The new laws on insurance, credit unions, financial services, and finance companies will start to apply from early January. A number of insurers left the market due to the gradual tightening of solvency and asset quality requirements. At the same time, the insurance sector has become more resilient. The payment market has been evolving rapidly. So far, the transaction volumes in this segment are insignificant, so it carries no systemic risks.